As the automotive industry continues its transformation and new generation vehicles (NGV) become more popular, there is a new approach to the way goods and materials flow from suppliers to manufacturers. At Kuehne+Nagel, we provide integrated and innovative supply chain solutions for players in the global automotive market and new mobility market. In our collaborations with customers, we have observed the following trends.

Which trends are accelerating the growth of New Generation Vehicles?

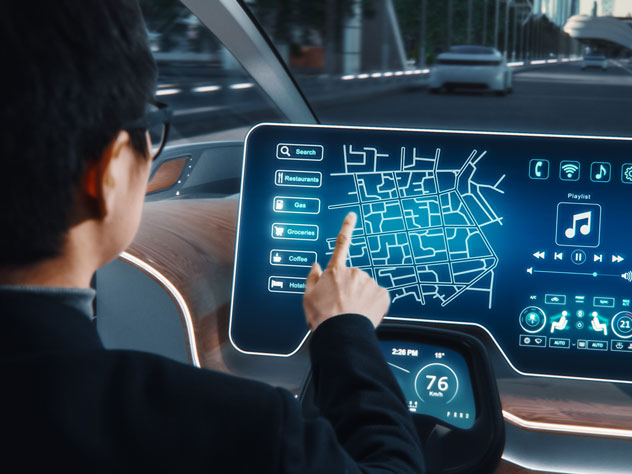

The new generation vehicle market is undergoing rapid growth, driven by government stimulus, early adoption consumers and technological breakthroughs in drive electrification, connectivity and autonomous driving. Fully driverless services are now a reality, with multiple firms offering this feature. Meanwhile, the driving range of electric vehicles is growing, with some cars able to drive up to 600 km before needing to recharge. Being able to update battery and driving software via the internet has created new opportunities for major technology players, who are diving into the electric vehicle (EV) software market.

These developments and the overall shift from traditional vehicles towards new generation vehicles have resulted in changes to the automotive supply chain. In fact, the way manufacturers handle inbound material flow is being re-designed from the ground up. What do these changes mean for the inbound automotive supply chain?

How these trends affect the inbound supply chain

The automotive supply chain is complex and includes suppliers from every corner of the globe. Disruption from changing trends has an effect on inbound supply chains. These implications include the following:

1. More options

Shipments will become smaller in size and higher in value. This requires more working capital in order to maintain stock levels. As shipment sizes become smaller, the choice of mode of transport increases. Currently, many shipments for parts and components are shifting from sea freight to air freight.

2. Increased care

The materials used are fragile and require improved packaging and higher levels of care when handling this cargo

3. Fewer parts

Compared to a combustion engine, which consists of thousands of moving parts, NGVs have an electric motor instead. The electricity may come from a battery (battery electric vehicle), solar panel (solar vehicle) or fuel cell (fuel cell vehicle). Because it runs on electricity, the vehicle emits no exhaust from the tailpipe and does not contain typical liquid fuel components, like fuel pump, fuel line, or fuel tank. Therefore, the overall Bill of Material is less complicated.

4. Production flexibility and adaptability

As new automotive technologies continue to get refined, production flexibility and adaptability will be fundamental to commercial success while transitioning from conventional internal combustion engine (ICE) to full battery EV. The assembly of NGVs is often highly automated. This means that logistics service providers require autonomous handling equipment and multi-sensor rapid scanning for line feeding and sequencing.

5. Premium battery costs

EV batteries are in high demand, but are heavy, bulky and considered a hazardous material that is dangerous if mishandled. All workers along the battery supply chain require proper training to handle these dangerous goods. Due to this risk, carriers are increasingly avoiding shipping lithium batteries. This makes cargo capacity scarce and battery transportation cost high. The need to invest in fire safety measures at warehouse facilities will also increase the cost of storing EV batteries.

These trends and their impact illustrate the significant changes inbound supply chains for NGVs will experience and the crucial role logistics companies will continue to play in providing support and expertise through it all.